Learn about the powerful optimisation and backtesting techniques used to refine trading strategies for enhanced performance.

The Hurst exponent, a key metric in algorithmic trading and quantitative finance, helps traders assess the long-term memory of a time series. It provides valuable insights into the persistence or mean-reversion tendencies of financial data, guiding trading strategy optimisation.

Leveraging the Hurst exponent can significantly enhance backtesting and optimisation processes, helping traders adjust strategies based on observed patterns. Read more on the applications of Hurst exponent in trading.

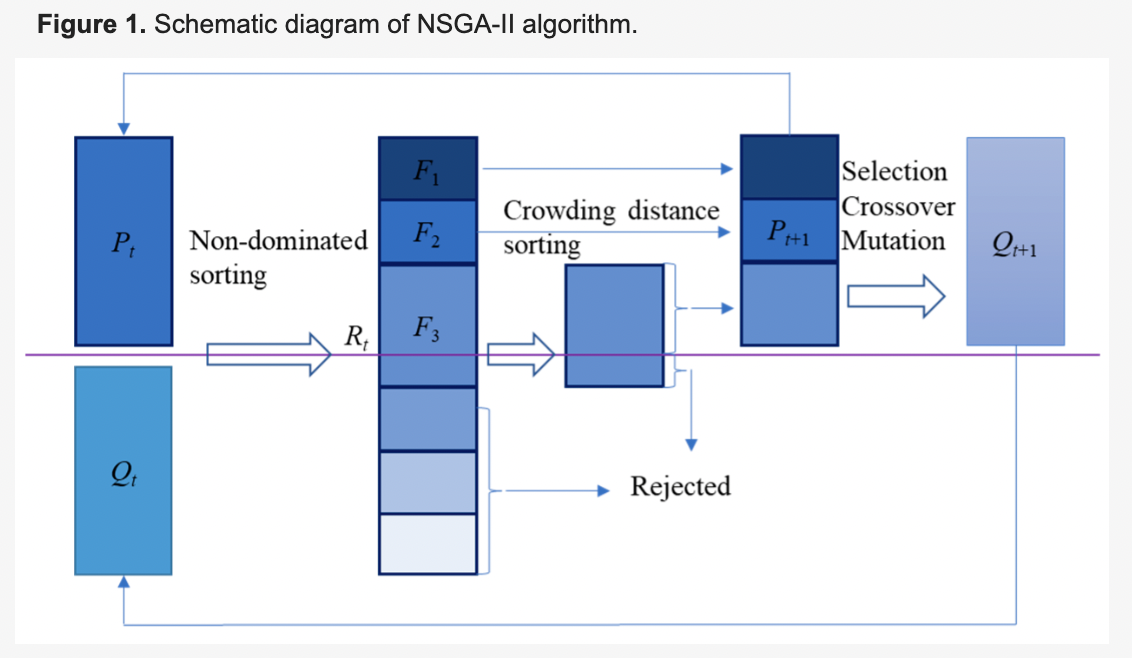

The NSGA-II algorithm (Non-dominated Sorting Genetic Algorithm II) is widely applied in multi-objective optimisation within finance, especially where multiple conflicting objectives, such as risk and return, must be balanced.

With features like fast non-dominated sorting and crowding distance, NSGA-II maintains diversity among optimal solutions, enhancing trading strategy development by retaining high-quality results over generations. This makes NSGA-II an ideal tool for algorithmic trading optimisation. Learn more about NSGA-II's role in multi-objective trading optimisation.

Our platform provides an end-to-end solution for developing, backtesting, and optimising trading strategies. This roadmap walks you through each step, ensuring your strategy is well-prepared for real market conditions.

Start by defining the objectives of your trading strategy. Are you aiming for trend-following, mean-reversion, or another approach? Key factors to set up include:

Backtesting allows you to assess strategy performance on historical data, a critical step for refining and validating your approach. Our backtesting module simulates trades based on past market conditions, producing key metrics:

By backtesting, you gain insights into how well your strategy performs, helping you identify strengths and weaknesses.

Optimisation fine-tunes your strategy’s parameters to maximize performance. Using techniques like NSGA-II optimisation, you can explore parameter combinations and identify the optimal settings. Some areas to optimise include:

Our platform’s optimisation tool provides a detailed report on the best parameter settings, streamlining the process of refining your strategy for higher performance.

After backtesting and optimisation, conduct a forward test by running the strategy in a simulated trading environment. This step tests the strategy on live data without risking capital, allowing you to observe how it responds to real-time market changes and verify its robustness.

Once satisfied with backtest and forward test results, you can choose to deploy the strategy on a paper account to test its robustness and/or go live.

Disclaimer on Past Performance and Data Accuracy: Any results generated through backtesting or optimisation of trading strategies within our services do not guarantee future performance. Past performance is not necessarily indicative of future results. Additionally, the data used for backtests may be incomplete, corrupted, or inaccurate in certain cases, leading to errors in the generated results. You acknowledge that Quant-Orbis Limited is not liable for any inaccuracies in the data or for any decisions made based on the results obtained through our platform. We encourage users to perform their own due diligence and analysis before making any financial decisions.

Backtesting is the process of evaluating a trading strategy's performance using historical data. It allows traders to assess how a strategy might have performed in past markets, enabling better-informed decision-making for future trades.

Optimisation tailors trading strategies to meet specific goals, balancing factors such as risk and reward. Techniques like the Hurst exponent and NSGA-II improve the precision of optimisation, helping traders adapt to changing market conditions.